What fascinated me about the chart was the degree of overvaluation exhibited by Canada, compared to Australia, which is trading at roughly its own historical average. The economies of Australia and Canada are similar in character. Both are resource based economies and about the same size. There is a minor difference as Australian resource industries tend to be more tilted toward the bulk commodities (i.e. coal and iron ore) whereas Canada has a higher weight in energy.

Long Australia/Short Canada

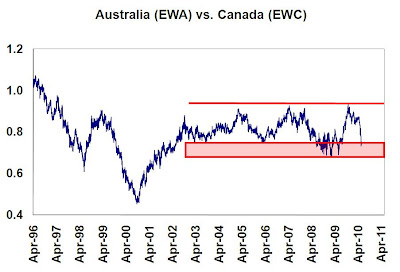

The chart below shows the relative total performance in USD, which takes out any currency effects, of the iShares Australia ETF (EWA) and the iShares Canada ETF (EWC). This chart suggests that Australian and Canadian markets have tracked each other relatively closely since late 2002 and Australia is now at the bottom of a trading range relative to Canada.

Hester’s analysis, combined with the above chart, screams out for a trade of going long Australia and shorting Canada.

The risk in the trade is seen in the recent steep selloff in the Australian market, attributable to the news of a super-tax of up to 40% being imposed on resource companies. Nevertheless, the trading range is indicative that the risk-reward ratio is positive for this pair trade and that most of the bad news is already in the Aussie market.

Here are some of the things that could go right for the trade:

- Australia took the lead, but the super-tax contagion could spread. How long would it take for budget constrained countries like Canada or Brazil to consider a form of super-tax on resource extraction companies? The 40% tax rate is awfully tempting and forms a very high ceiling rate from which to impose a new tax. Sympathy for resource extraction companies is low, especially in offshore oil extraction given BP’s environmental and public relations nightmare.

- The Australian government has indicated that the door is open in changes to the tax regime. While the news is bad right now, the Aussie market could rally should the government step back and ease up its tax proposal.

- The Reserve Bank of Australia is ahead of the curve in its monetary policy, as it has moved into tightening mode. By contrast, the Bank of Canada remains behind the curve in its monetary policy. What would happen to the Australia/Canada spread if and when the BoC tightens?

1 comment:

Nice chart.

They both have two adjacent superpowers with a discombobulated Europe between them.

George Friedman of Stratfor is big on proxemics.

What kind of macro numbers other than shipping would one look at to gauge a global trade like this?

Future earnings certainly look best in Asia, especially some of the smaller cheap labour countries like Vietnam and Thailand.

John Mauldin theme for 2010 was EEM and VWO when they pulled back because our valuations are too high.

http://online.barrons.com/article/SB126300612284422737.html#articleTabs_panel_article%3D1

Post a Comment